- Trade Balance : 17th Dec., 10:00 GMT. The euro zone seasonally adjusted trade surplus widened to 11.3 billion Euros, above analyst’s forecast for 9.5 billion Euros surplus. Exports dropped 1.1% on September from 3.3% gain in August while imports declined by 2.7% from 2.3% registered in August.

- German Ifo Business Climate : 19th Dec., 9:00 GMT. This index climbed in November to 101.4, from 100 in October, opposing to predictions of more decline in sentiment. The reading may have been influenced by helpful data from the US and China. A climb to 101.9 is estimated now.

- Current Account : 19th Dec., 9:00 GMT. The surplus of the eurozone’s current account plunged to 0.8 billion euros in September following 10.9 billion euros the August. The surplus over the 12 months to September, exposed a surplus of 77.8 billion, compared with a shortfall of 7.6 billion in the same period last year. Current account surplus is projected to rise to 5.8 billion.

- German Producer Price Index : 20th Dec., 7:00 GMT. Producer Price Index remained unmoved in October opposing to predictions of a 0.1% gain, following a 0.3% increase in the earlier month. The 12 month decline in Producer Price Index was not reflected in the core PPI; signifying output prices remain constrained by weak domestic demand. The forecast is a decline of 0.1%.

- NBB Business Climate – Belgium : 20th Dec., 14:00 GMT. Confidence among Belgian business leaders has grown in November to -13.4 from -13.5 in the previous month. Economists forecasted an un-changed reading. Additional decline to -14.3 is forecasted.

- Eurozone - Consumer Confidence : 20th Dec., 15:00 GMT. Euro zone consumer confidence fallen in last month to -27 following -25.7 in October caused by the debt crisis. Even under severe cuts, a raise to -26 is projected now.

- GfK Consumer Climate – Germany : 21st Dec., 7:00 GMT. This indicator dropped in November to 5.9 from 6.1 in October, upon the current debt crisis in the Union. Even with this decline, the survey shows Germans do not fear recession. Household sentiment remains to be acceptable and private expenditure is continuing to be the main strength in the German economy. No change is estimated.

Technical lines from top to bottom:

1.3600 – Strong Resistance

1.3480 – Strong Resistance

1.3400 – Strong Resistance

1.3290 – Strong Resistance

1.3170 – Strong Resistance ( Keep an eye for break or

bounce )

1.3130 – Weak Resistance

1.3000 – Strong Support

1.2880 – Strong Support

1.2750 – Strong Support

1.2690 – Strong Support

4 Comments

Hi,

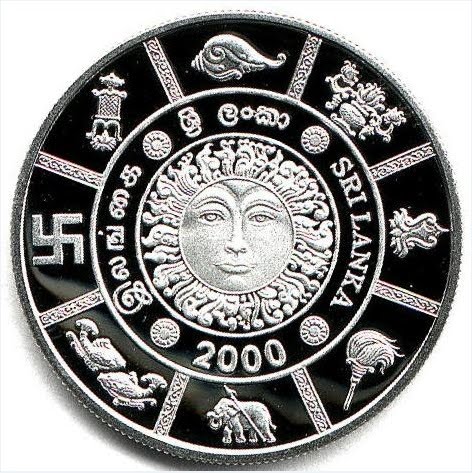

ReplyDeleteDo you know how Income tax apply to forex trading income in Sri Lanka?

Cheers,

Nick

Hi,

ReplyDeleteMy name is Neil Shaffer I’m the Affiliate Manager at BinaryOffers.com,

The biggest Affiliate Network for Binary Options and Forex.

I’d like to invite you to join us and you will enjoy

The highest commissions in the industry !!!

The best tracking system used by companies like Zynga and Sears !!!

Dedicated affiliate manager that will work for you !!!

And most important get paid on time, every time !!!

I am available to you via email or Skype (aff.binaryoffers) for your convenience

Thank you in advance for your response

Best Regards,

Neil Shaffer

Neil@binaryoffers.com

Wonderful blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News?

ReplyDeleteFirst of all I would like to thank you for the great and informative entry. I have to admit that I have never heard about this information related to Forex Signals. Thanks a lot for sharing this useful information and I will be waiting for other interesting posts from you in the nearest future. Keep it up.

ReplyDelete